Initiating Coverage | Banking

July 18, 2018

Yes Bank

BUY

CMP

`380

Growth affirmed

Target Price

`435

Yes Bank (YES), incorporated in 2004, is a private Indian bank. It is promoted by

Investment Period

12 Months

Mr. Rana Kapoor with financial support of Rabobank and Global investor - AIF

Capital and Chrys Capital. Despite competition from well established private

Stock Info

banks, it has been able to grow its balance sheet at steady pace. The bank’s

Sector

Banking

advances have grown at healthy CAGR of 32% over FY2010-18. It has branch

Market Cap (` cr)

87,870

network of 1,100 (Q4FY18 end) and CASA ratio of 37%. Corporate lending forms

Beta

1.3

67.9% of advances and commercial/retail 32.1%.

52 Week High / Low

385/286

Avg. Daily Volume

7,01,397

Focus on high rated accounts leads to 54% credit growth in FY18: YES has been

Face Value (`)

2

able to grown its loan book at CAGR of 32% over FY2010-18. For FY18, credit

BSE Sensex

36,519

grew by 54% primarily led by corporate book, with a focus on high rated

Nifty

11,008

corporate accounts (overall corporate portfolio continues to be well rated with

Reuters Code

YESB.NS

nearly 80% portfolio rated ‘A’ or better). Business with high rated corporate would

Bloomberg Code

YES.IN

help YES to generate fee income and build retail liabilities (CASA). Consumer

lending in FY18 grew by 98% and contributes 12.2% of the total loan book.

Shareholding Pattern (%)

Improving asset quality and minimal impact of stress resolution: There was a large

Promoters

20.0

divergence in the bank’s GNPA reporting (`6,300cr) and RBI review of FY2017.

MF / Banks / Indian Fls

24.8

However, within short span of time, YES upgraded 47% of divergence accounts,

remaining accounts were either repaid or sold to ARC and classified as NPA.

FII / NRIs / OCBs

42.6

GNPA/NPA for Q4FY18 declined to

1.28%/0.64% from

1.52%

/0.81% in

Indian Public / Others

12.6

Q4FY17. Net stressed assets also declined to 1.7% from 2.25% of advances.

Exposure to RBI IBC list 1 is `320cr with 50% provision and to the IBC list 2 is

`650cr with 42% provision. However, YES Bank expects minimal impact due to RBI

Abs. (%)

3m 1yr

3yr

stress resolution frame work.

Sensex

5.8

14.6

28.4

CASA growth and rating improvement to support NIM: CASA deposit has grew at

Yes Bank

22.1

21.1

128.3

CAGR of 51% over FY2015-18 and 41% YoY taking the CASA ratio to 36.5%.

Recently, CARE has upgraded its rating to ‘AAA’ with stable outlook for YES Bank.

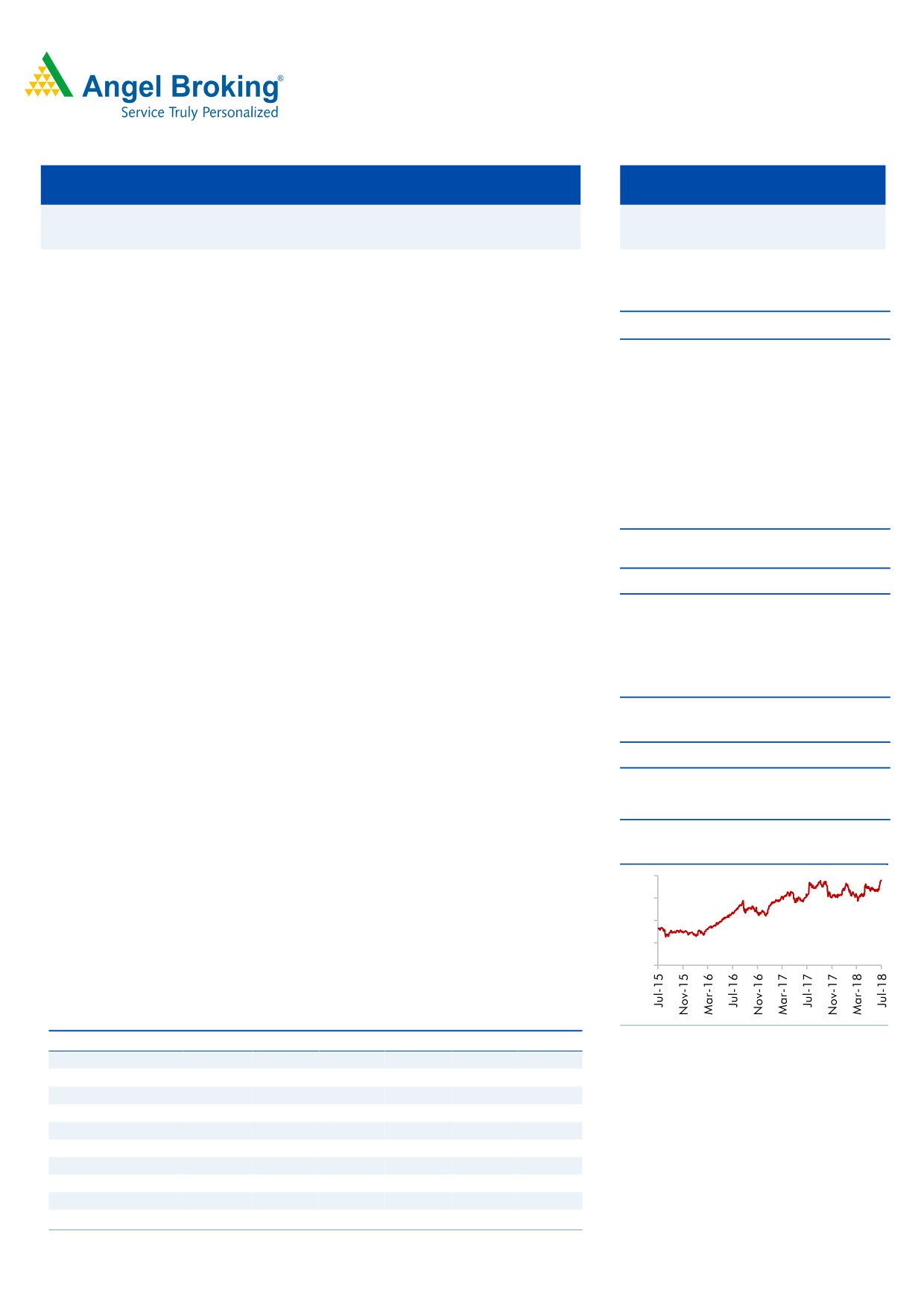

3-year price chart

These factors would support the bank’s target to achieve 4% NIM by March 2020.

400

Outlook & Valuation: We expect YES Bank to grow its advances at CAGR of 32%

300

over FY2018-20E. Improvement in CASA, rating up-gradation and in-house

200

priority sector lending would support NIM going forward. At CMP, YES trades at

100

2.4x FY20E P/ABV, which we believe is attractive considering growth prospects,

0

hence, we recommend BUY with a target price of `435 over the next 12 months.

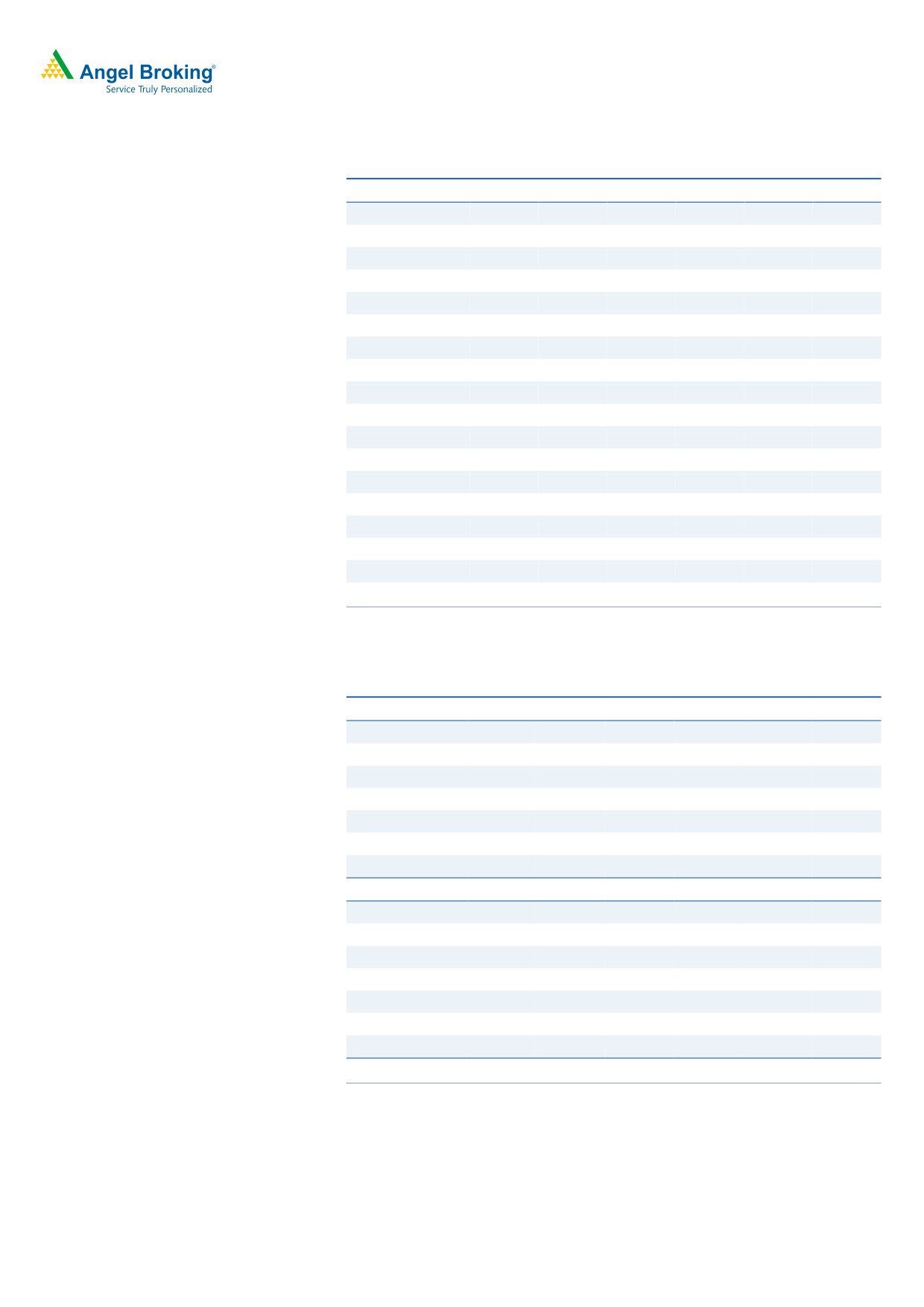

Key Financials (Standalone)

Source: Company, Angel Research

Y/E March

FY15

FY16

FY17

FY18

FY19E

FY20E

NII

3,488

4,567

5,797

7,737

10,593

13,967

% Chg

28

31

27

33

37

32

Net Profit

2,005

2,539

3,330

4,225

5,951

7,851

% Chg

24

27

31

27

41

32

NIM (%)

3.1

3.3

3.4

3.3

3.2

3.2

EPS (`)

9

11

14

18

26

34

P/E (x)

44

35

26

21

15

11

Jaikishan Parmar

P/BV (x)

7.5

6.4

4.1

3.5

2.9

2.4

022 - 39357600 Ext: 6810

RoA (%)

1.6

1.7

1.8

1.6

1.6

1.6

RoE (%)

21

20

19

18

21

23

Source: Company, Angel Research; Note: CMP as of July 17, 2018

Please refer to important disclosures at the end of this report

1

Yes Bank | Initiating Coverage

Credit growth of 54% in FY18 with focus on high rated account

YES has been able to grown its loan book at CAGR of 32% over FY10-18. For

FY18 advance grew by 54% primarily led by corporate book with a focus on high

rated corporate. (Overall corporate portfolio continues to be well rated with nearly

80% portfolio rated ‘A’ or better). Healthy advance growth due to 1) large private

banks (ICICI & Axis bank) are reluctant to lend their large and mid corporate

portfolio owing to continues asset quality issues. 2) Many PSU banks are in pause

mode as RBI has placed them under Prompt Corrective Action (PCA) owing to

capital constraint and stubbornly high bad asset (GNPA).

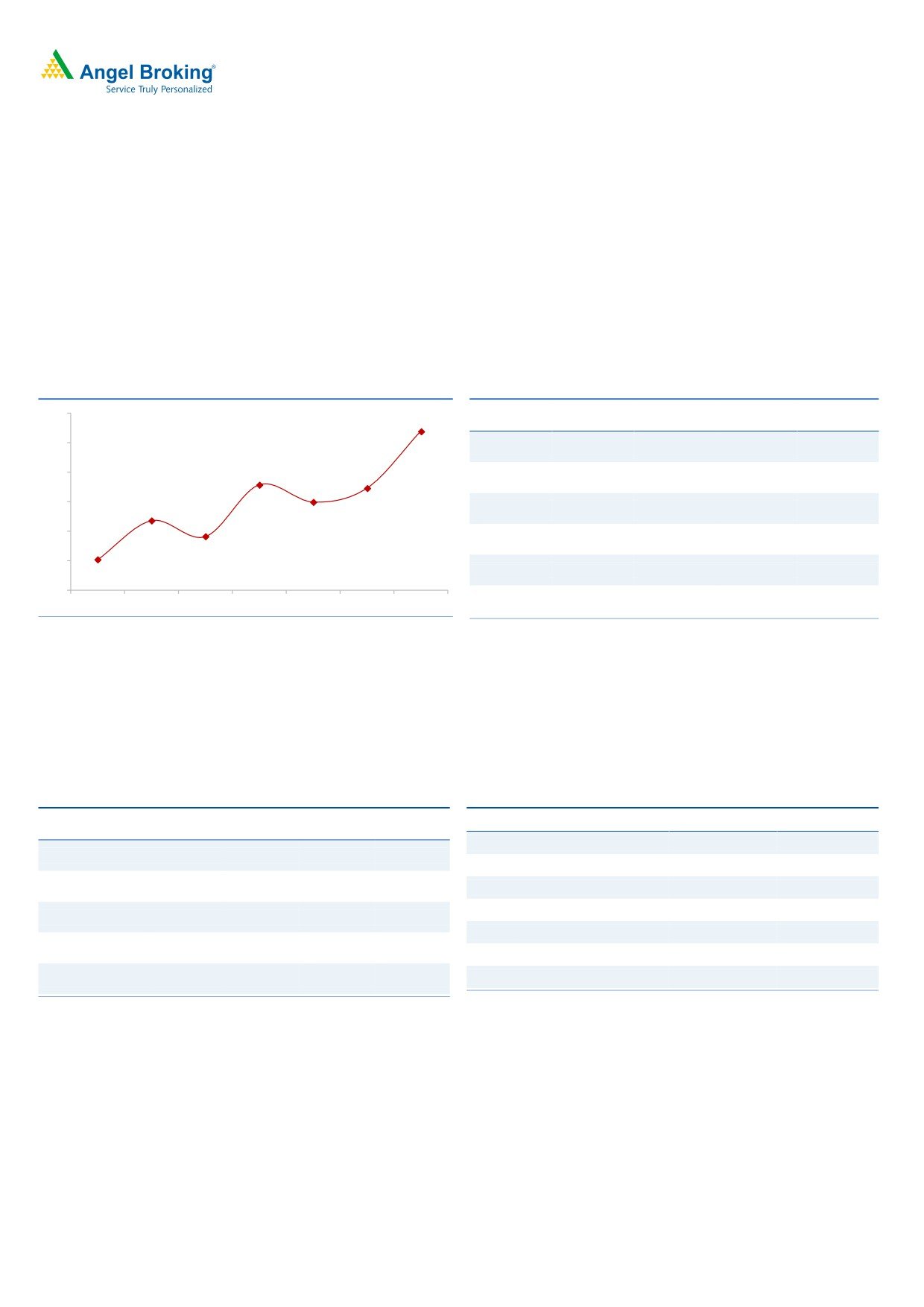

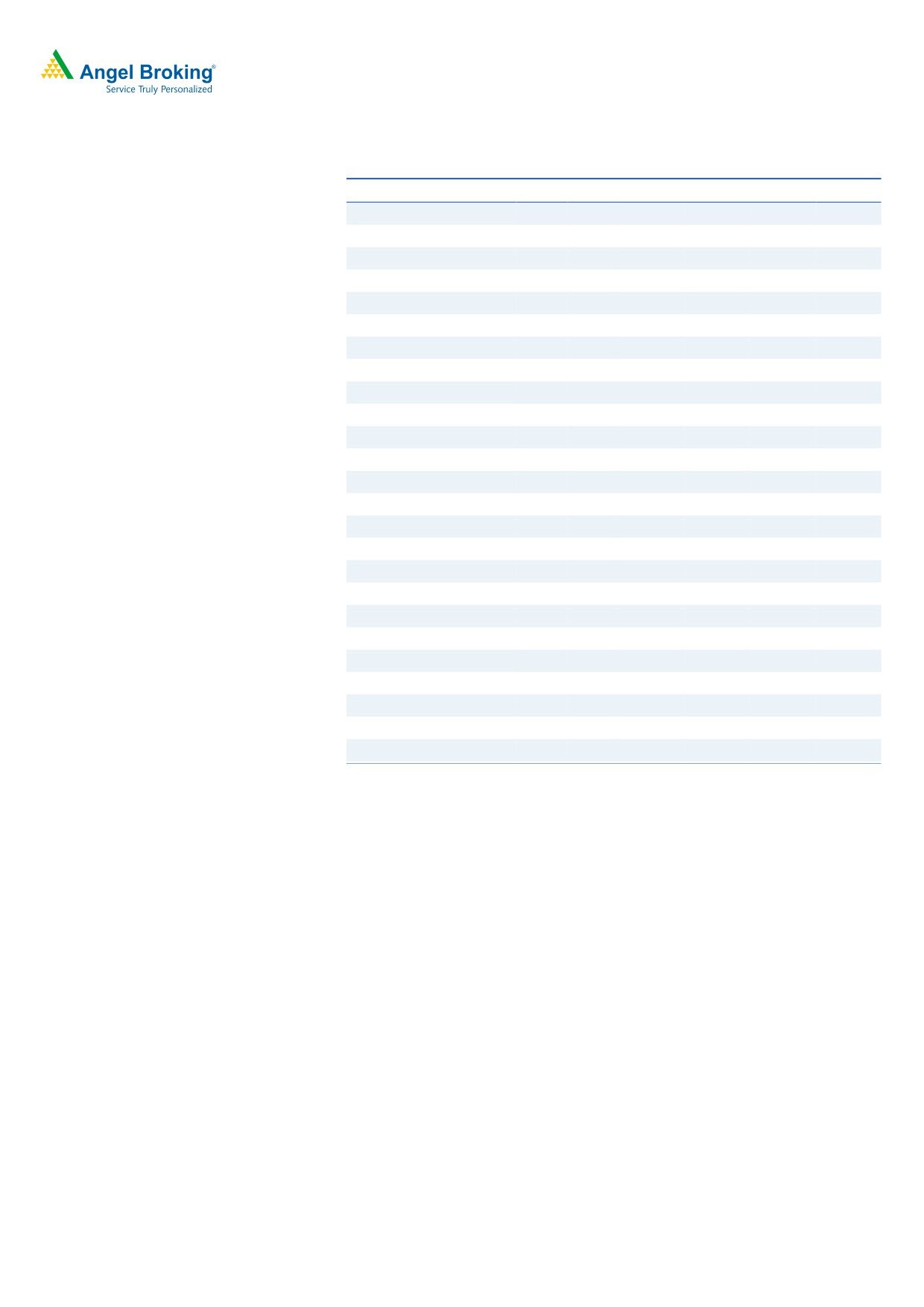

Exhibit 1: Credit Growth (YoY)

Exhibit 2: Nearly 80% portfolio rated A or better...

60%

54%

(%)

FY15

FY16

FY17

FY18

50%

AAA

20.3

18.4

20.9

23.2

40%

36%

35%

AA

14.9

18.5

15.6

13.3

30%

30%

24%

A

41.6

39.6

39.6

42.9

18%

20%

BBB

20.8

21.7

21.8

18.5

11%

10%

BB & below

2.5

1.8

2

2.2

0%

FY12

FY13

FY14

FY15

FY16

FY17

FY18

Total

100

100

100

100

Source: Company

Source: Company

YES has been focusing to improve retail business, incremental high rated lending

to abate NIM for short term. However, it would help bank to build CASA and

generation of fees income. Core retail advance grew by 98% in FY18 which

constitute 12.2% of loan book (7.3% in 1QFY16).

Exhibit 3: Loan Mix

Exhibit 4: CASA Trend

Segment

FY15

FY16

FY17

FY18

CA (%)

SA (%)

CASA (%)

FY12

9.9

5.1

15.0

Corporate banking

68

65.1

67.7

67.9

FY13

10.0

9.0

18.9

Medium Ent

14.1

11.1

10.5

9.7

FY14

9.5

12.6

22.0

FY15

9.3

13.8

23.1

SME

10.6

13

12.3

10.3

FY16

9.8

18.3

28.1

Retail Banking

7.3

10.8

9.5

12.2

FY17

13.4

22.9

36.3

Total

100

100

100

100.1

FY18

14.4

22.1

36.5

Source: Company

Source: Company

We believe expect YES to grow its loan book at CAGR of 33% over FY18-20E.

Present asset quality issue for certain corporate lender would help banks with

stronger balance sheet to grow faster than industry. Moreover, NCLT resolution of

large account would also create fresh demand for credit. We believe proper

understanding of at least some of these accounts, balance sheet strength and the

inability of several corporate-focused lenders to lend would propel YES Bank

advance.

July 18, 2018

2

Yes Bank | Initiating Coverage

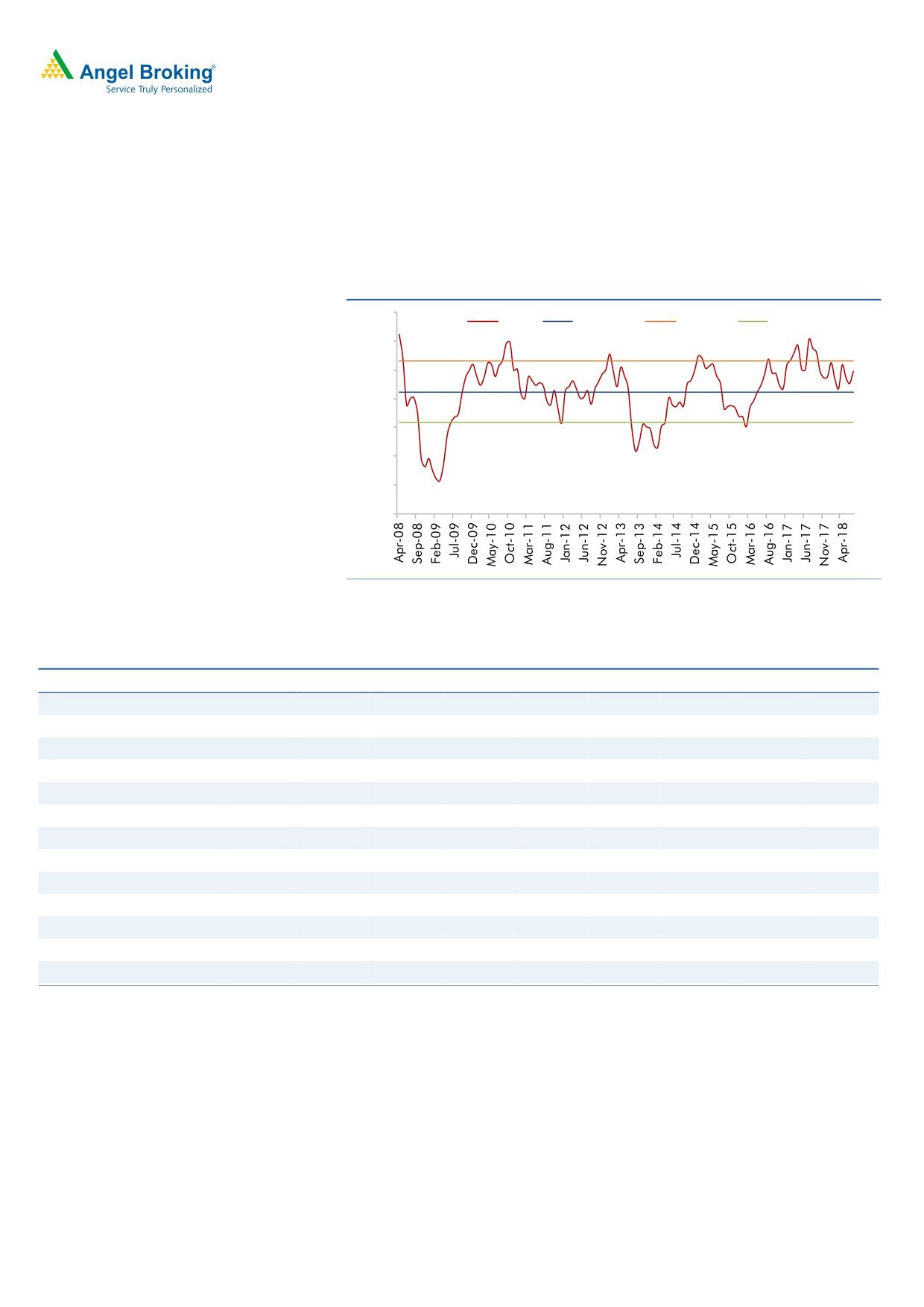

Improving asset quality and minimal impact of stress resolution:

At the end of FY2017, the RBI judged the bank’s gross NPAs at `8,373cr. The

bank, however, had reported gross NPAs at `2,018cr. The consequent divergence

was at

`6,355cr or three times the reported amount. However, bank’s

management acted immediately and 47% of the divergence amount had been

upgraded in the first half of the year. Another 27% of that amount was repaid,

while 19% was classified as NPA at the end of the September quarter. Much of the

remaining amount was sold to asset reconstruction companies.

GNPA/NPA for Q4FY18 declined to 1.28%/0.64% from 1.52%/0.81% in Q4FY17.

Net stressed asset also declined to 1.7% (Q4FY18) from 2.25% (Q3FY18) of

advances. Exposure to RBI IBC list 1 is `320cr with 50% provision and to the IBC

list 2 is `650cr with 42% provision. However, YES Bank expects minimal impact

due to RBI stress resolution frame work.

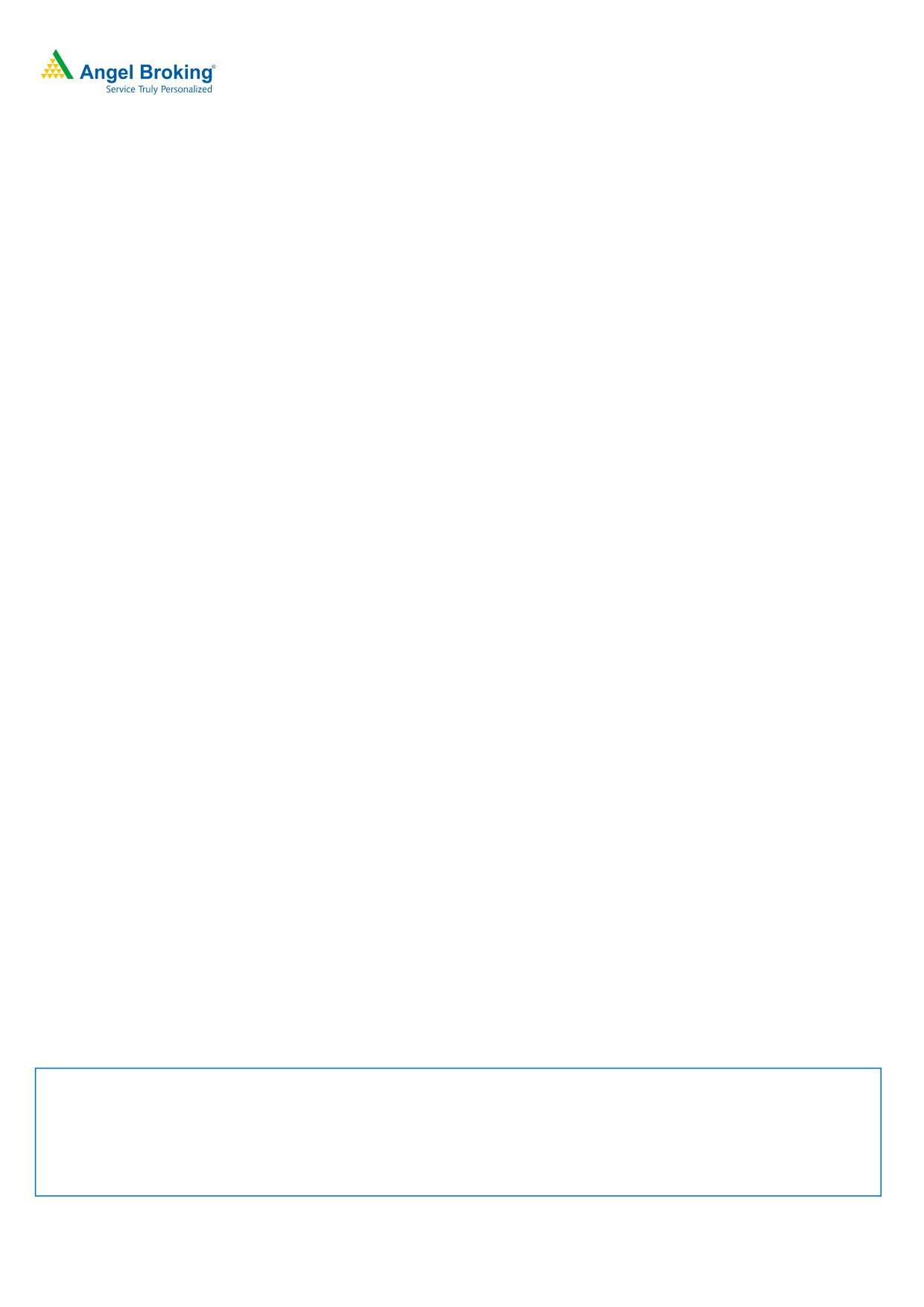

Exhibit 5: GNPA & NPA Trend

Asset Quality (%)

FY13

FY14

FY15

FY16

FY17

FY18

FY19E

FY20E

Gross NPAs

0.20

0.31

0.41

0.76

1.52

1.28

1.25

1.25

Gross NPAs (`in cr)

94

175

313

749

2,019

2,627

3,435

4,465

Net NPAs

0.01

0.05

0.12

0.29

0.81

0.64

0.55

0.50

Net NPAs (`in cr)

7

26

88

284

1,072

1,313

1,511

1,786

Credit Cost on Advance

0.46

0.65

0.45

0.55

0.60

0.76

0.70

0.70

Provision Coverage

0.93

0.85

0.72

0.62

0.47

0.50

0.56

0.60

Source: Company

Exhibit 6: Exposure to sensitive sectors

Sensitive Sector

Total (%)

A or Above (%)

Iron & Steel

2.0

1.5

Electricity

2.7

telecom

2.2

1.9

Gems & jewelry

1.4

0.9

Source: Company

Standard restructured portfolio was flat qoq at `91cr in Q4FY208 (16bps of loans)

from `90.3cr in 3QFY18, while SDR portfolio declined to 0 from `362cr in 3Q.

During the quarter, YES sold 2 NPA accounts to an ARC, SR book declined to

0.92% from 1.07% of advances in 3QFY18. Standard S4A exposure declined to

`139cr from `154cr in 3QFY18.

CASA growth and rating improvement to support NIM: CASA deposit grew at

CAGR of 51% over FY15-18 and 41% YoY taking the CASA ratio to 36.5%.

Recently, CARE has upgraded the bank’s rating to ‘AAA’ with stable outlook. These

factors would support YES Bank’s target to achieve 4% NIM by March 2020.

July 18, 2018

3

Yes Bank | Initiating Coverage

Outlook & Valuation: We expect YES Bank to grow its advances at CAGR of 32%

over FY2018-20E. Improvement in CASA, rating up-gradation and in-house

priority sector lending would support NIM going forward. At CMP, YES trades at

2.4x FY20E P/ABV, which we believe is attractive considering growth prospects,

hence, we recommend BUY with a target price of `435 over the next 12 months.

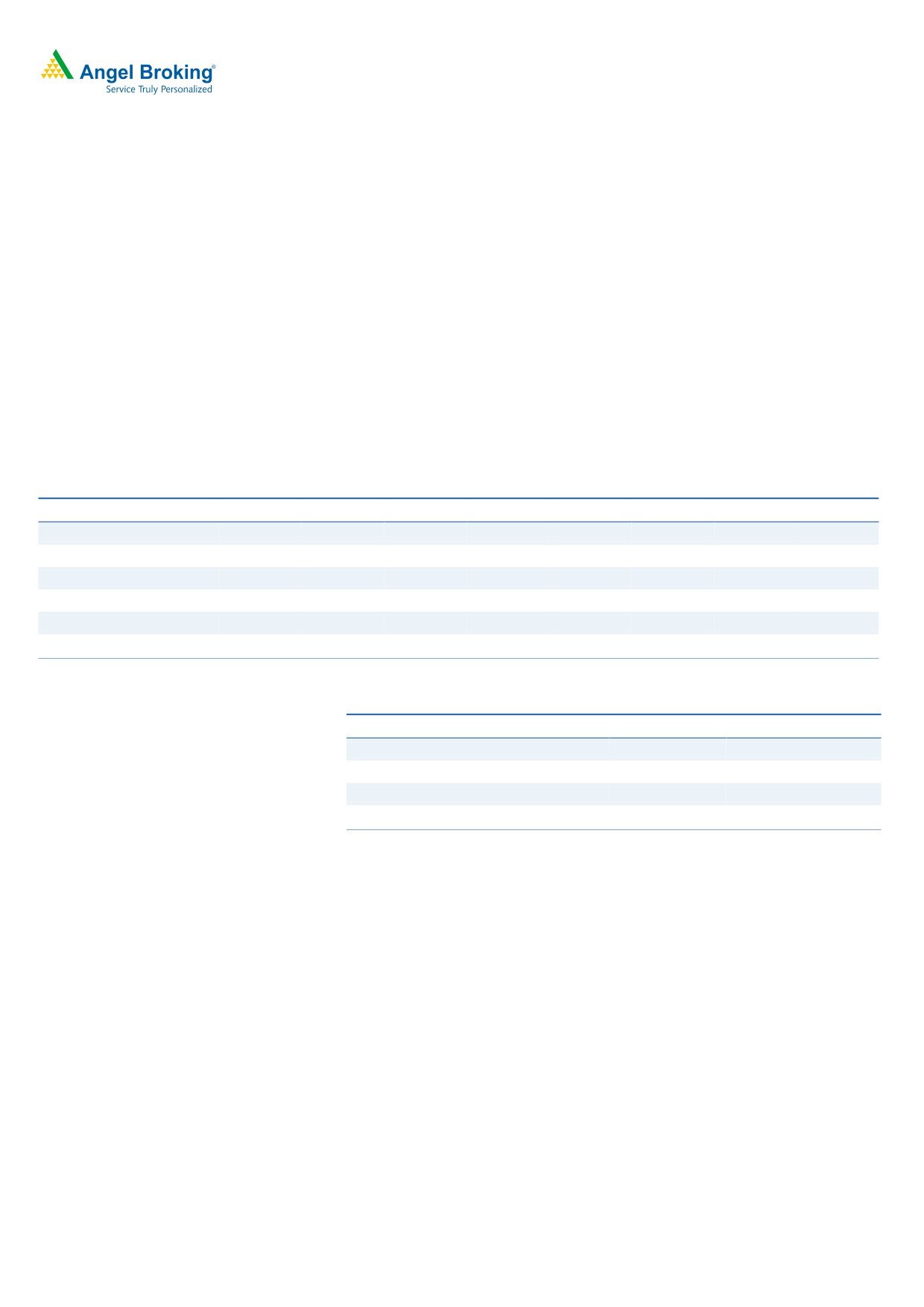

Exhibit 7: One year forward P/B

3.50

P/BV

Avg. P/BV

+1STD

-1STD

3.00

2.6

2.50

2.5

2.1

2.00

1.50

1.6

1.00

0.50

0.00

Source: Company

Exhibit 8: DuPont Analysis (%)

Particular

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19E

FY20E

Interest Income

9.5

9.6

9.6

9.4

9.0

8.6

7.7

7.8

7.9

Interest Expenses

7.1

7.0

7.0

6.6

5.9

5.6

4.8

4.9

5.0

NII

2.4

2.6

2.6

2.8

3.0

3.0

2.9

2.9

2.9

- Prov

0.1

0.3

0.3

0.3

0.4

0.4

0.6

0.5

0.5

Adj NII

2.3

2.3

2.3

2.6

2.7

2.6

2.3

2.4

2.4

Total Other Income

1.3

1.5

1.7

1.7

1.8

2.2

2.0

2.0

2.0

Total Income

3.6

3.8

3.9

4.2

4.5

4.8

4.3

4.4

4.4

Opex

1.4

1.5

1.7

1.9

2.0

2.2

2.0

2.0

2.0

PBT

2.2

2.2

2.2

2.4

2.5

2.7

2.3

2.4

2.4

TAX

0.7

0.7

0.7

0.7

0.8

0.9

0.7

0.8

0.8

RoA

1.5

1.5

1.6

1.6

1.7

1.8

1.6

1.6

1.6

Leverage

15.7

16.5

16.1

13.0

11.8

10.6

11.0

12.9

14.1

RoE

23.1

24.8

25.0

21.3

19.9

18.6

17.7

21.1

23.2

Source: Company,

July 18, 2018

4

Yes Bank | Initiating Coverage

Key risks

If the bank takes longer time to build its retail portfolio and increase CASA, then it

could adversely impact NIMs.

Higher than expected slippages would increase credit cost and impact the

profitability of the bank.

Lower-than-expected loan growth and loss of key management personnel poses a

risk for the bank’s performance.

Company Background

Yes Bank (YES), incorporated in 2004, is a private Indian bank. It is promoted by

Mr. Rana Kapoor with financial support of Rabobank and Global investor - AIF

Capital and Chrys Capital. Despite competition from well established private

banks, it has been able to grow its balance sheet at steady pace. The bank’s

advances have grown at healthy CAGR of 32% over FY2010-18. It has branch

network of 1,100 (Q4FY18 end) and CASA ratio of 37%. Corporate lending forms

67.9% of advances and commercial/retail 32.1%.

Key management Personnel

Mr. Ashok Chawla has been on the Board of Yes Bank since March 05, 2016 and

was appointed as Independent Director of the Bank by the Shareholders in 12th

Annual General Meeting (AGM) on June 07, 2016 for a period of five years. Prior

to joining Yes Bank, Mr. Chawla was the Chairman of the Competition

Commission of India (CCI). He has obtained Masters in Economics from the Delhi

School of Economics in 1972 and joined the Indian Administrative Service in 1973.

Mr. Rana Kapoor has been serving as the Managing Director & CEO of the Bank

since September 01, 2004. He holds an MBA degree from Rutgers’ University in

New Jersey, U.S.A. (1980), and Bachelor’s degree in Economics (Honours) from

the University of Delhi (1977).

Mr.Raj Ahuja has been appointed as CFO in April 2018. Prior to joining Yes Bank,

Raj was CFO and Head of Enterprise functions at Reliance Jio Infocomm Ltd. He

has over 26 years of rich experience in managing finance and allied areas,

operations, compliance and regulatory aspects.

July 18, 2018

5

Yes Bank | Initiating Coverage

Income Statement

Y/E March ( `cr)

FY15

FY16

FY17

FY18

FY19E

FY20E

Net Interest Income

3,488

4,567

5,797

7,737

10,593

13,967

- YoY Growth (%)

28

31

27

33

37

32

Other Income

2,046

2,712

4,157

5,224

7,414

9,796

- YoY Growth (%)

19

33

53

26

42

32

Operating Income

5,534

7,279

9,954

12,961

18,007

23,763

- YoY Growth (%)

25

32

37

30

39

32

Operating Expenses

2,285

2,976

4,117

5,213

7,202

9,545

- YoY Growth (%)

31

30

38

27

38

33

Pre - Provision Profit

3,250

4,302

5,838

7,748

10,805

14,218

- YoY Growth (%)

21

32

36

33

39

32

Prov. & Cont.

339

536

793

1,554

1,923

2,500

- YoY Growth (%)

(6)

58

48

96

24

30

Profit Before Tax

2,910

3,766

5,044

6,194

8,882

11,718

- YoY Growth (%)

25

29

34

23

43

32

Prov. for Taxation

905

1,227

1,714

1,970

2,931

3,867

- as a % of PBT

31

33

34

32

33

33

PAT

2,005

2,539

3,330

4,225

5,951

7,851

- YoY Growth (%)

24

27

31

27

41

32

Source: Company

Balance Sheet

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E

FY20E

Equity

418

421

456

461

461

461

Reserve & Surplus

11,262

13,366

21,598

25,298

30,177

36,615

Networth

11,680

13,787

22,054

25,758

30,638

37,076

Deposits

91,176

1,11,720

1,42,874

2,00,738

2,66,370

3,53,319

- Growth (%)

23

23

28

41

33

33

Borrowings

26,220

31,659

38,607

74,894

1,00,357

1,29,461

Other Liab. & Prov.

7,094

8,098

11,525

11,056

18,797

21,198

Total Liabilities

1,36,170

1,65,263

2,15,060

3,12,446

4,16,163

5,41,053

Cash Balances

5,241

5,776

6,952

11,426

15,181

20,140

Bank Balances

2,317

2,442

12,597

13,309

17,517

23,238

Investments

43,228

48,838

50,032

68,399

91,086

1,20,839

Advances

75,550

98,210

1,32,263

2,03,534

2,74,771

3,57,202

- Growth (%)

36

30

35

54

35

30

Fixed Assets

319

471

684

832

1,168

1,549

Other Assets

9,516

9,526

12,532

14,946

16,441

18,085

Total Assets

1,36,170

1,65,263

2,15,060

3,12,446

4,16,163

5,41,053

Source: Company

July 18, 2018

6

Yes Bank | Initiating Coverage

Exhibit 9: Key Ratio

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E

FY20E

Profitability ratios (%)

NIMs

3.1

3.3

3.4

3.3

3.2

3.2

Cost to Income Ratio

41.3

40.9

41.4

40.2

40.0

40.2

RoA

1.6

1.7

1.8

1.6

1.6

1.6

RoE

21.3

19.9

18.6

17.7

21.1

23.2

B/S ratios (%)

CASA Ratio

0.23

0.28

0.36

0.36

0.38

0.39

Credit/Deposit Ratio

0.8

0.9

0.9

1.0

1.0

1.0

Asset Quality (%)

Gross NPAs

0.41

0.76

1.52

1.28

1.25

1.25

Gross NPAs (Amt)

313

749

2,018

2,626

3,434

4,465

Net NPAs

0.12

0.29

0.81

0.64

0.55

0.50

Net NPAs (Amt)

87

284

1,072

1,312

1,511

1,786

Credit Cost on Advance

0.45

0.55

0.60

0.76

0.70

0.70

Provision Coverage

72%

62%

47%

50%

56%

60%

Per Share Data (`)

EPS

8.7

11.0

14.5

18.3

25.8

34.1

BV

50.7

59.9

95.8

111.8

133.0

161.0

ABVPS (75% cover.)

50.7

59.4

93.3

109.0

130.2

158.1

DPS

1.8

2.0

2.4

2.7

4.7

6.1

Valuation Ratios

PER (x)

43.7

34.5

26.3

20.8

14.7

11.2

P/BV

7.5

6.4

4.0

3.4

2.9

2.4

P/ABVPS (x)

7.5

6.4

4.1

3.5

2.9

2.4

Dividend Yield

0.5

0.5

0.6

0.7

1.2

1.6

Note - Valuation done on closing price of 17/07/2018

July 18, 2018

7

Yes Bank | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Yes Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

July 18, 2018

8